pay ohio business taxes online

Taxpayers can make online payments through CRISP. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use.

Online Services Business Taxes Department Of Taxation

The tax is a flat rate of 150 for receipts up to 1000000 and then 26 after tha t.

. Heres how you know. Heres how you know. The self-employment tax is a social security and Medicare tax for individuals who work for themselves.

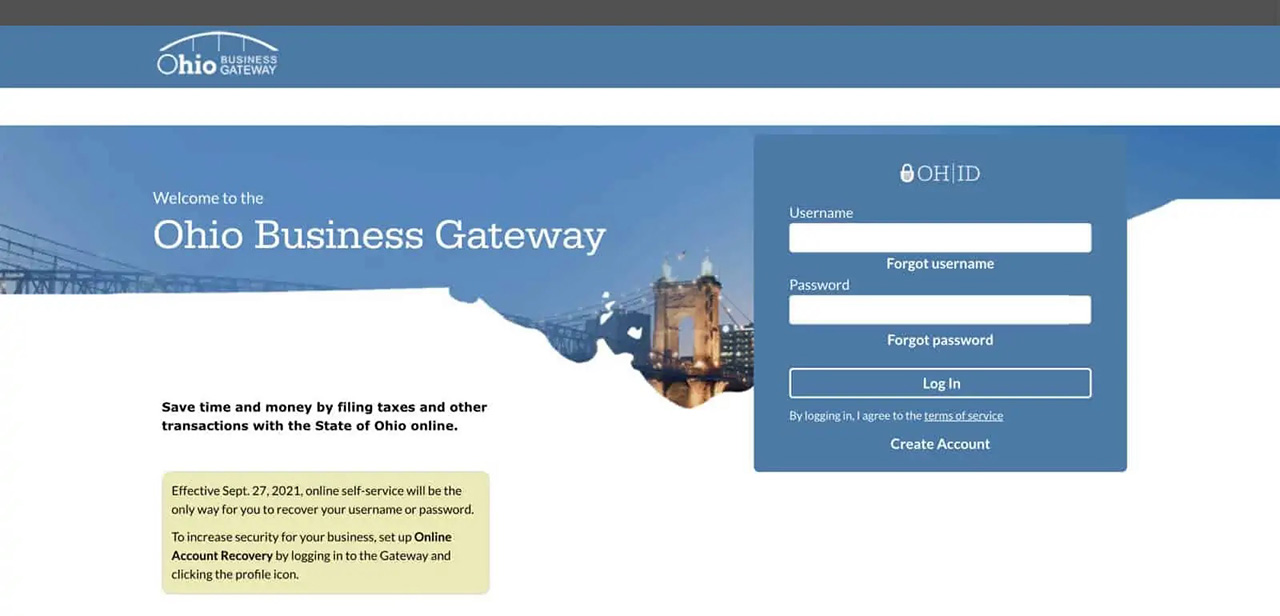

Gateway Taxation applications will be under maintenance and unavailable on Friday 09162022 between 530 PM to 730 PM. Cleveland Tax Credit Information. Ohio businesses can use the Ohio Business Gateway to access various services and.

An official State of Ohio site. To pay by credit card or debit card using a touch-tone telephone call the toll-free number 1. EASY PAYMENTS VIA PHONE INTERNET OR THE OHIO BUSINESS GATEWAY.

Our office is currently closed to the public for walk in traffic. Other options include In Person. However we are accepting taxpayers by appointment only.

In cooperation with the State of Ohio ACI Payments Inc. Payments by Electronic Check or CreditDebit Card. Any business that is above that threshold must file a commercial activity tax return and pay a tax.

Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online. Ohio Business Taxes Web Content Viewer. We accept online payments for individual income taxes employer withholding and business taxes.

One Government Center Suite 2070. Follow these steps and youll be on your way. Regional Income Tax Agency.

Ohio Business Taxes April 23 2020 Agency. Save time and money by filing taxes and other transactions with the State of Ohio online. Save time and money by filing taxes and other transactions with the State.

Several options are available for paying your Ohio andor school district income tax. Online Services for Business. City of Kettering Income Tax Division 3600 Shroyer.

CRISP allows individuals and businesses to. Your business may be required to file information returns to report. An official State of Ohio site.

Offers businesses the opportunity to pay taxes by phone online or via the Ohio Business Gateway. The City of Dayton Income Tax Ordinance 31288-14 levies an annual income tax of two and one quarter percent 225 and Ordinance 31501-16 levies an additional income tax of one. Please note that the Division does not accept any cash payments.

Learn about starting a business in Ohio. It is our aim to make payment as convenient as. Home Business Taxes.

Cuyahoga County Fiscal Officer. Several options are available for paying your Ohio andor school district income tax. ACI Payments Inc the.

Pay Online - Ohio Department of Taxation tip taxohiogov. Business Taxes Web Content Viewer. You can use this site to safely and confidentially pay outstanding obligations that have been certified to the Attorney Generals office.

Online Services for Business.

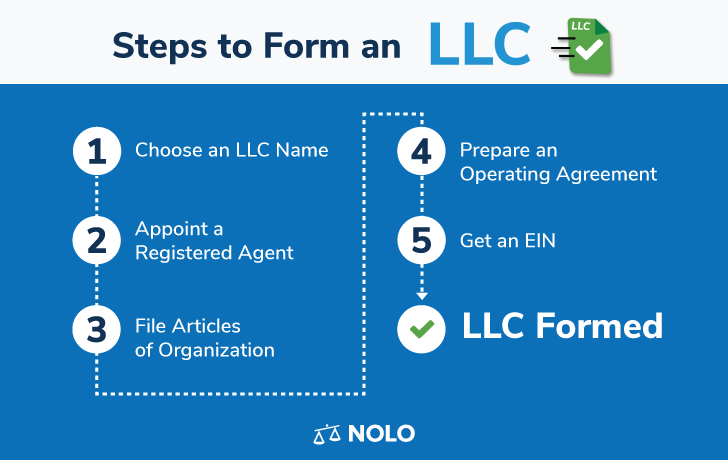

Form An Ohio Llc How To Start An Llc In Ohio Nolo Nolo

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Ohio Business Gateway Department Of Taxation

Free Llc Tax Calculator How To File Llc Taxes Embroker

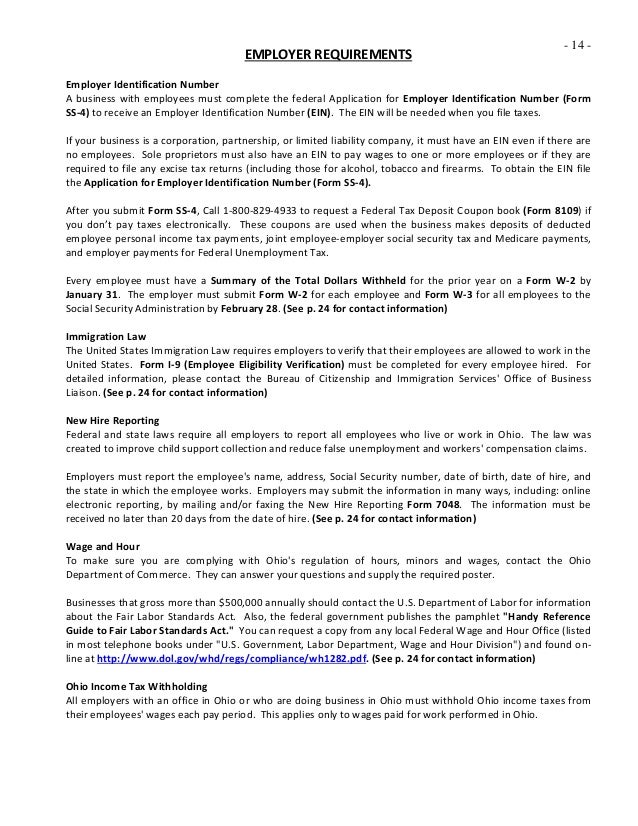

1st Stop Starting Your Business In Ohio 2014

Oh I Received A Sales Tax Delinquency Penalty For Over 3 000 For A Business That I Closed 18 Months Ago I Don T Understand Why This Happened And Could Really Use Some Help

![]()

Llc Ohio How To Start An Llc In Ohio Truic

Llc Tax Calculator Definitive Small Business Tax Estimator

Income Tax City Of Gahanna Ohio

How To Start An Llc In Ohio For 49 Llc Oh Application Zenbusiness Inc

Ohio Business Gateway Ohio Gov Official Website Of The State Of Ohio

How Much Is Llc In Ohio Costs Breakdown

2022 Federal State Payroll Tax Rates For Employers

Starting A Business Ohio Secretary Of State